What does an attack by China on Taiwan mean for German companies? Can the goals of the European chip law be achieved? Kloepfel Consulting, which specialises in supply chains, randomly surveyed 104 managers of medium-sized companies on this issue.

The online survey, which took place from 15 April to 17 May 2023, provides insights to better understand the potential impact of such an attack on German companies. The survey results show a clear trend regarding the importance of trade relations with China and Taiwan as well as the dependence on electronic components and potential impact on supply chains.

Majority rates trade relations with China as important

Trade relations with China are rated as important to very important by the majority of companies. According to the survey, 79 per cent of respondents consider these relationships to be significant, while only 14 per cent said they were less important. For 7 percent of the companies, trade relations with China have no relevance.

Trade relations with Taiwan of high importance for half

A similar picture emerges for trade relations with Taiwan. About half of the companies, 52 percent, consider these relations to be of high to very high importance. For 30 percent of the respondents, they are less important, while 18 percent stated that these relations do not play a role for their company.

Conflict between China and Taiwan: companies fear serious impact on supply chains

The survey results also make clear that a war between China and Taiwan would have a significant impact on companies’ supply chains. Seventy-eight per cent of respondents expect such a disruption to have a major to very major impact on their supply chains. Only 15 percent expect only a minor impact, while 7 percent said their supply chains would not be affected at all.

Marc Kloepfel, CEO of Kloepfel Group, explains: “To mitigate the impact of a conflict between China and Taiwan on supply chains, companies need to explore alternative sources of supply. Geographical diversification of supply chains, identification of backup suppliers and re-evaluation of make-or-buy strategies can help minimise the impact of a disruption and build business resilience.”

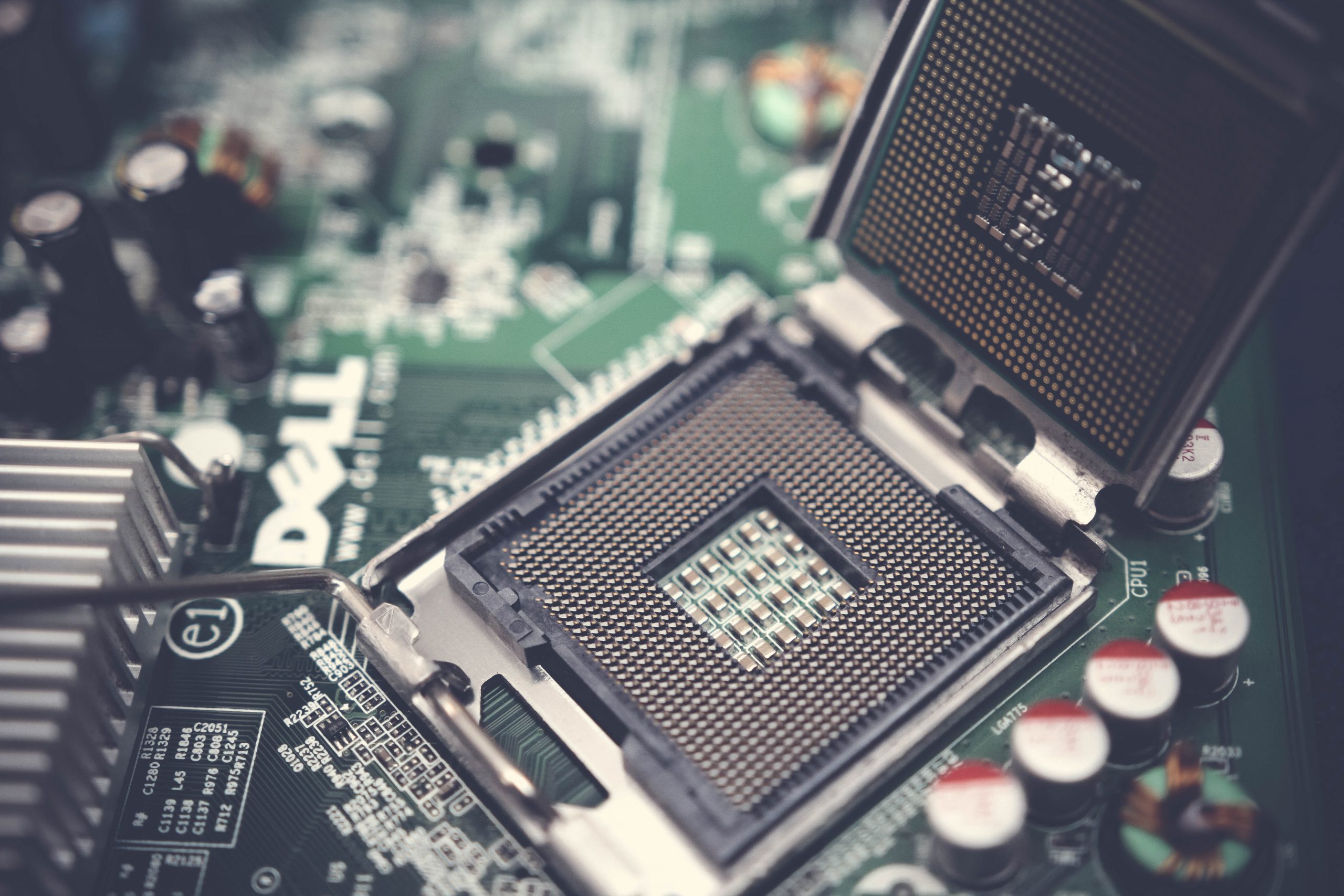

Electronic components such as semiconductors important to most companies

64 per cent of respondents said electronic components such as semiconductors are important to very important to their business. For 19 per cent of companies, they are less important, while 17 per cent said they are unimportant to their business.

60 percent fear significant supply bottlenecks of electronic components from Taiwan

The survey results show that a disruption in the supply chain of electronic components from Taiwan would mean a strong to very strong impact for 60 percent of the companies. For 23 per cent, the impact would be minor, while 17 per cent say their company would not be affected at all.

Duran Sarikaya, Managing Director Kloepfel Consulting, says: “Companies should invest in technology partnerships and cooperations to strengthen their innovation capacity in the field of electronic components. By sharing know-how and collaborating with research institutes and start-ups, new solutions can be developed and innovative products brought to market.”

Europe and China dominate as main suppliers of electronic components to companies

The survey also shows that Europe and China are the main sources of electronic components for companies. 65 per cent of the companies surveyed source these components from Europe, followed by China with 63 per cent. Taiwan is in third place with 44 per cent. 33 per cent of the companies source components from the USA, while 29 per cent source from Japan. South Korea is also on the list of sources with 23 per cent. For 15 per cent of the companies, sourcing comes from other areas. It should be noted that 26 per cent of the companies stated that they do not source electronic components. Multiple answers were possible for this question.

The source of supply Europe does not rule out that preliminary products nevertheless come from China and Taiwan. On the other hand, it is encouraging that electronics procurement is already spread across several countries. This suggests some scope for a geographical shift away from China and Taiwan.

Doubts about achieving the goals of the European chip bill

Finally, the survey provides assessments on the achievement of the goals of the European Chip Bill. According to the survey, 25 per cent of respondents believe that the goals of the European Chip Bill can be achieved, but not without challenges. 33 percent of respondents said they are undecided, while 20 percent are sceptical and do not believe the goals can be achieved. 22 per cent have no opinion on the issue.

Sectors involved

The participant structure of the survey included representatives from various industries and companies with an annual turnover of up to 500 million euros.

Mechanical and plant engineering represented the largest group with a share of 30 percent, followed by the electrical industry and trade with 10 percent each. The automotive industry took a share of 9 percent, while the health care sector and the non-food consumer goods industry each accounted for 5 percent. Other sectors represented included the

Chemicals, Service Providers, Metals, Construction, Special Vehicles, IT, Consumer Goods Food, Furniture and Pharmaceuticals, each of which had a share of 4 per cent or less. About 10 per cent of the participants belonged to other industries.